22+ Partial claim mortgage

The Partial can be up to 30 of the amount owed. The mortgagor must execute a mortgage in favor of HUD with terms and conditions acceptable to HUD for the amount of the partial claim under 203414a.

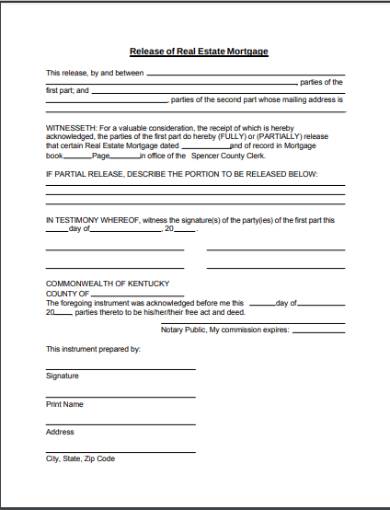

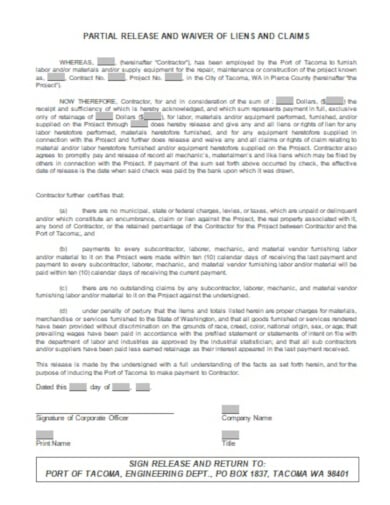

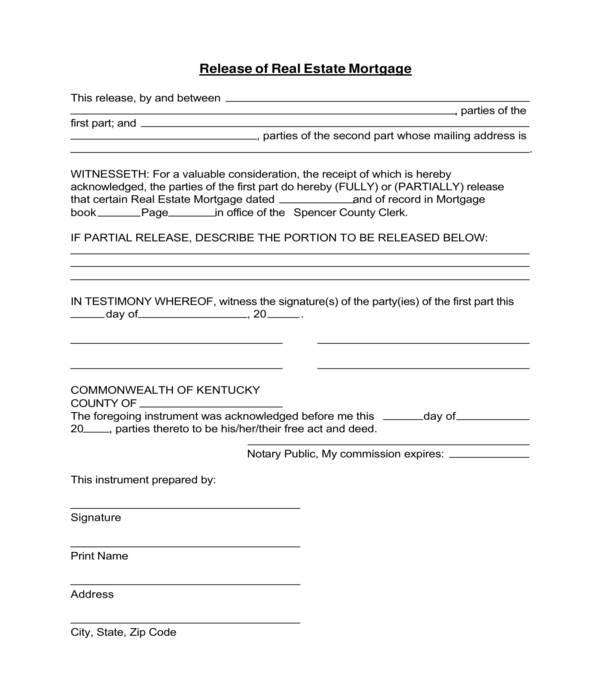

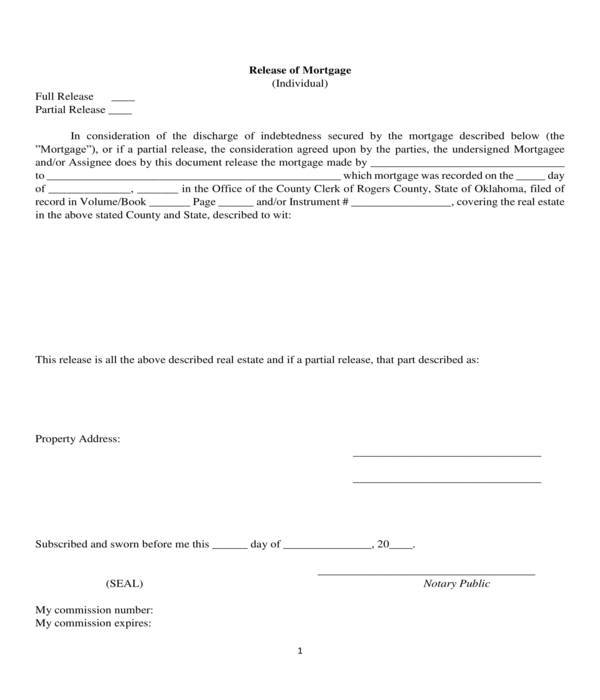

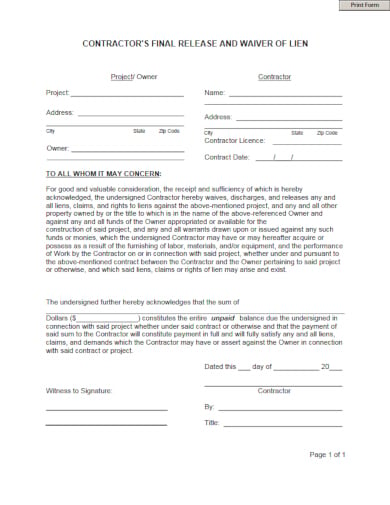

Free 5 Real Estate Lien Release Forms In Pdf

HUD can advance up to 12 months of mortgage payments through this program.

. The partial claim does not need to be paid off until the property is sold or the first mortgage is paid off. The Borrower only pays the Partial Claim if the home is sold or refinanced. The partial claim total can not exceed 12 months of payment including the principal interest taxes and insurance.

The current Trulia Estimate for 709 Fawn Creek St is 264600. VAPCP will only be available from July 27 2021 through October 28 2022. This single-family home was most recently listed for sale with MLS 2334150 by the real.

Skip to first item. COVID-19 Recovery Modification. How does a partial claim help me transition off.

With this process you will be able to have funds forwarded to you in order to get your mortgage loan current again. A partial claim is an interest-free loan from HUD to get caught up on overdue payments on an FHA loan and is usually completed along with a loan modification or forbearance. The Borrower makes monthly payments of principal and interest on the first loan and the second loan or Partial Claim is a separate mortgage which does require monthly payments and does not carry interest.

D Application for insurance benefits. The FHA partial claim is a loss mitigation procedure that is offered in conjunction with HUD. A partial claim is a non-interest bearing lump sum amount of money that gets recorded against a property as a subordinate lien to the primary mortgage.

This beautiful 4 bedroom 3 bathroom single-family home in Leavenworth County Kansas was originally constructed in 1989 and contains 2416 square feet. The partial claim amount becomes due at the maturity date of your mortgage. The VA Partial Claim Payment VAPCP is a temporary program that is intended to assist Veteran borrowers specifically impacted by the COVID-19 pandemic to resume making their regular pre-COVID mortgage payments after exiting forbearance.

For homeowners who cannot resume making their current monthly mortgage payments the COVID-19 Recovery Modification extends the term of the mortgage to 360 months at a fixed rate and targets reducing the borrowers monthly principal and interest portion of their monthly mortgage payment. This beautiful 3 bedroom 3 bathroom single-family home in Leavenworth County Kansas was originally constructed in 1989 and contains 2183 square feet of living space with a 2 car garage. How you could benefit.

The COVID-19 Recovery Modification. 21022019 A partial claim is an interest-free loan from HUD to get caught up on overdue payments on an FHA loan and is usually completed along with a loan modificationThe partial claim does not need to be paid off until the property is sold or the first mortgage is paid off. VA Partial Claim Program Purpose.

To qualify for a partial claim on an FHA loan borrowers must be between 4 and 12 months behind on their mortgage payments. View detailed information about property 741 Fawn Creek St Leavenworth KS 66048 including listing details property photos school and neighborhood data and much more. From Main St- go west on Eisenhower north on Shrine Park Rd west on Fawn Creek St to home on the right.

Ad LawDepot Has You Covered with a Wide Variety of Legal Documents. This property is not currently available for sale. 22-070 HUD Public Affairs 202 708-0685 FOR RELEASE Monday April 18 2022 FEDERAL HOUSING ADMINISTRATION ADDS 40-YEAR MORTGAGE MODIFICATION WITH PARTIAL CLAIM TO HOME RETENTION OPTIONS FOR STRUGGLING BORROWERS Addition to loss mitigation home retention options allows servicers to assist.

709 Fawn Creek St Leavenworth KS 66048 is a 4 bedroom 35 bathroom 806 sqft single-family home built in 1989. The home must also be the borrowers primary residence and remain their primary home if HUD approves the partial claim. Take a look.

In order to qualify for this process you must have an FHA loan. 709 Fawn Creek St was last sold on Nov 1 1996 for 105000. If you owe more than 12 months you will need to pay the remaining balance so that you will qualify for the partial mortgage claim.

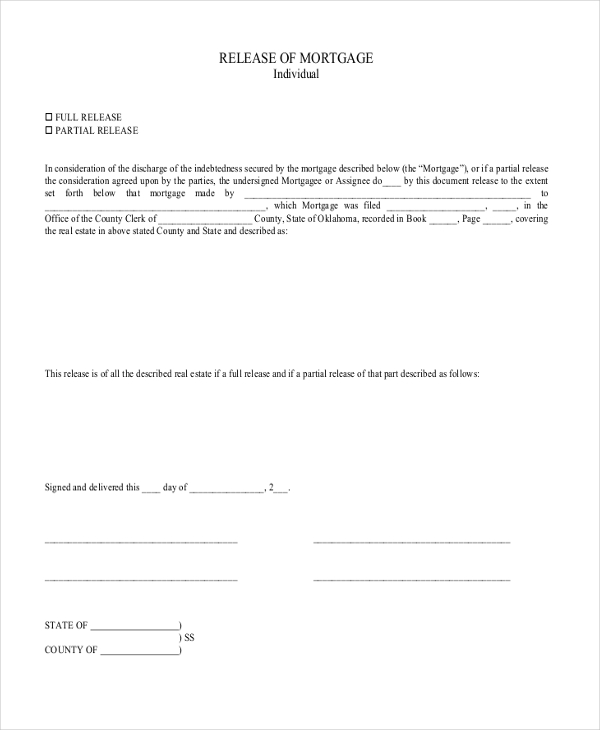

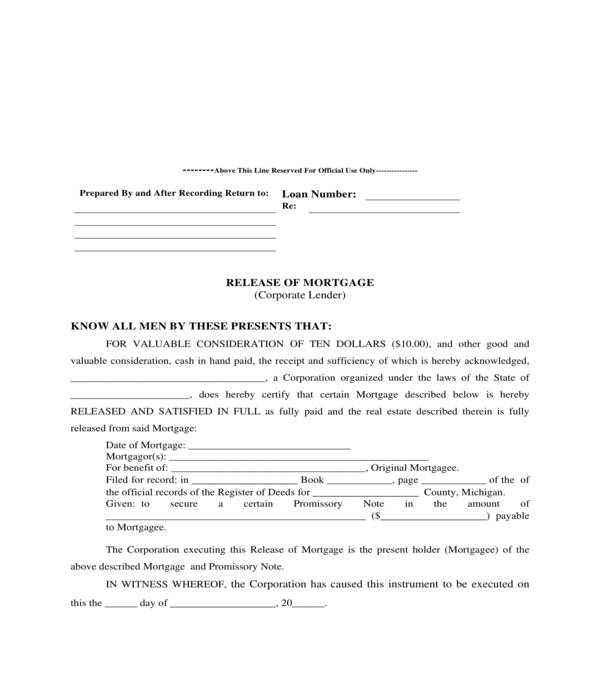

Create Your Release of Mortgage. An FHA Partial Claim FNMA Principal Forbearance or USDA Mortgage Recovery Advance is a reimbursement of a mortgagee advancement of funds on behalf of the borrower in an amount necessary to assist in reinstating the delinquent mortgage. HUD may require the mortgagee to be responsible for servicing the subordinate mortgage on behalf of HUD.

The partial claim gets recorded on title as a lien underneath your first mortgage.

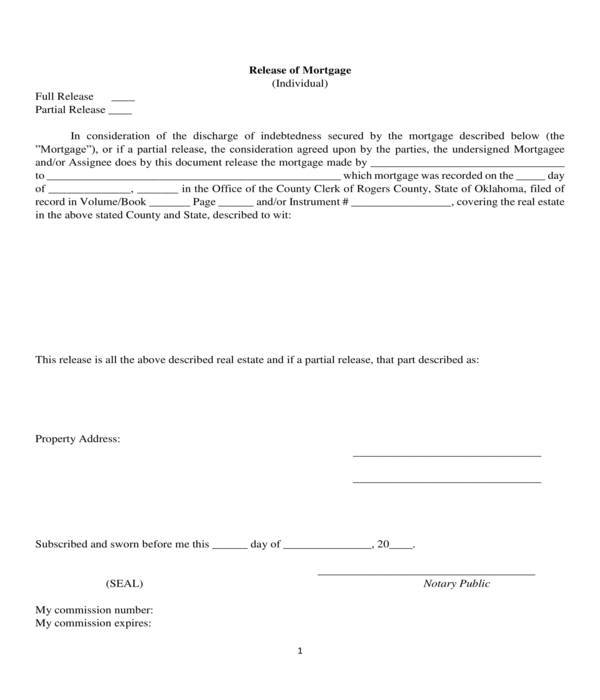

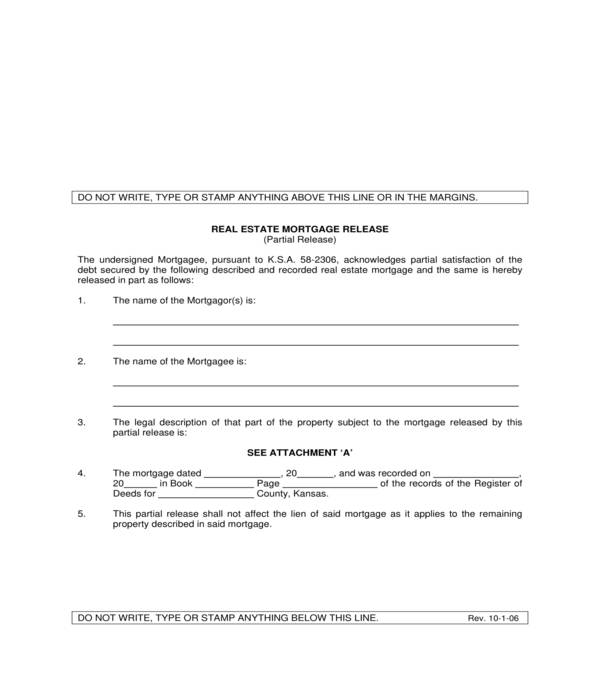

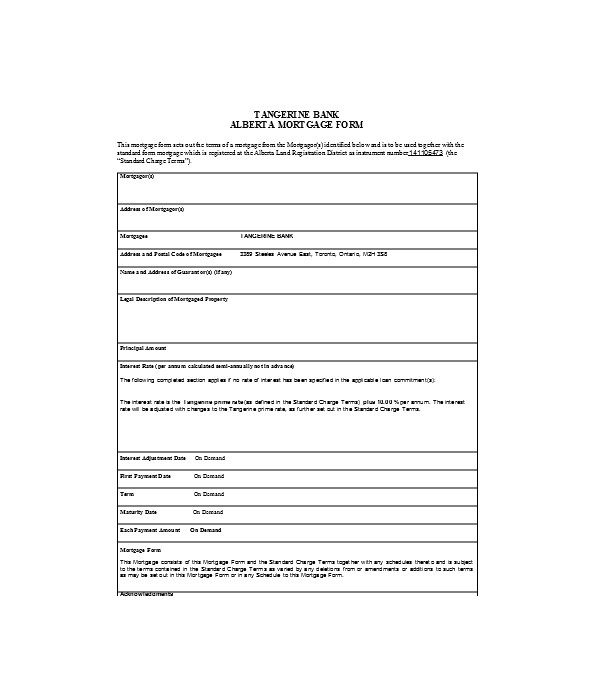

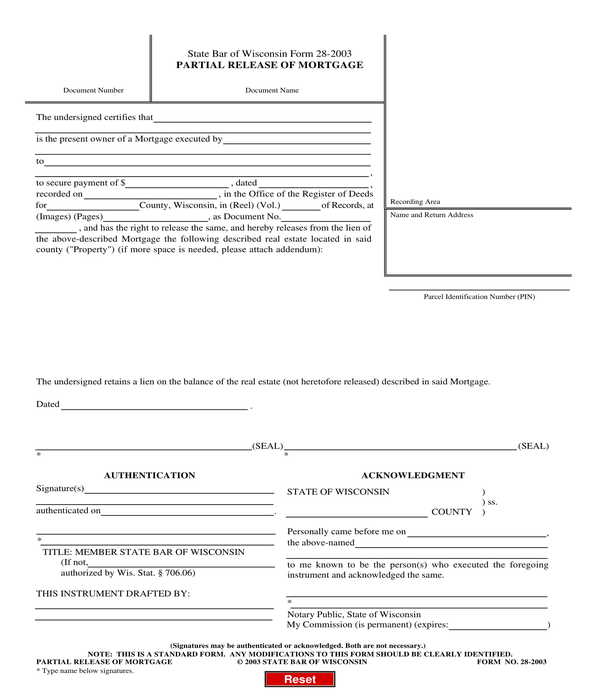

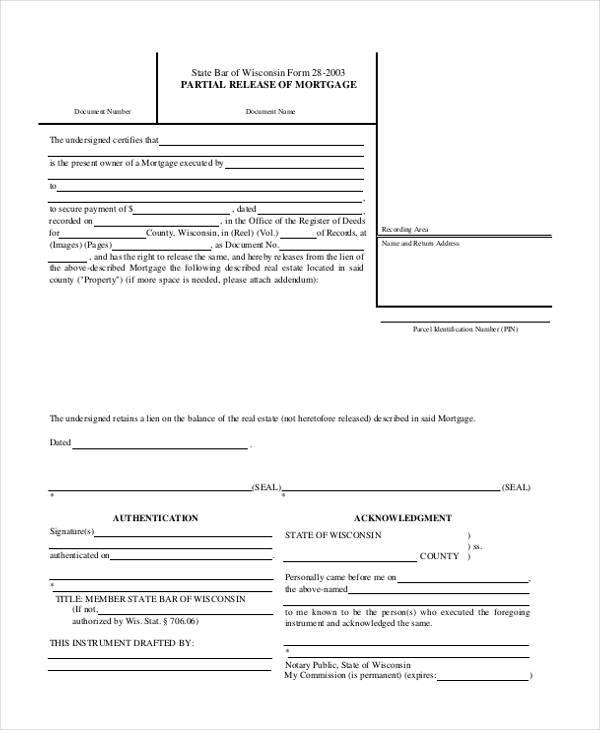

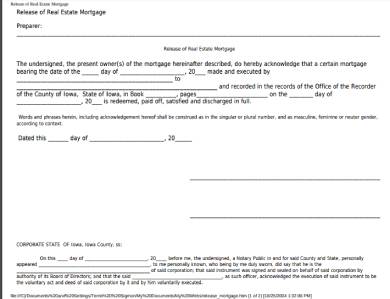

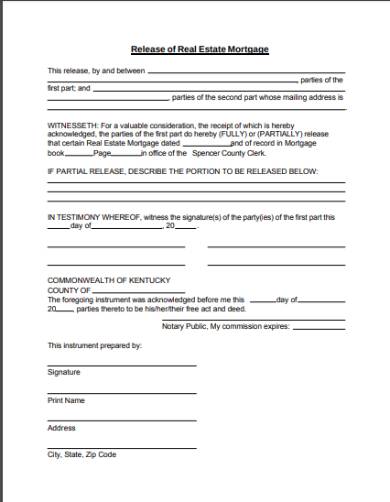

Free 6 Mortgage Release Forms In Pdf Ms Word

2

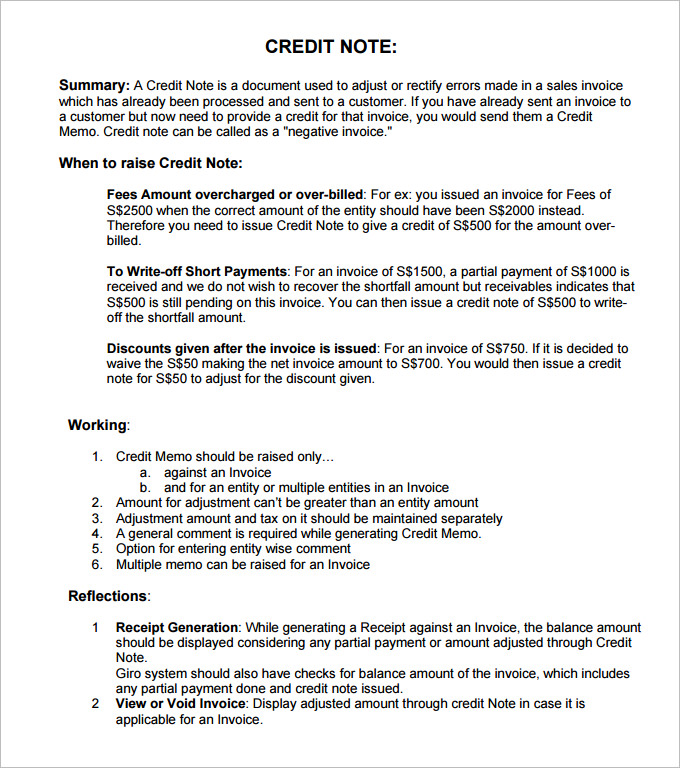

22 Credit Note Templates Word Excel Pdf Free Premium Templates

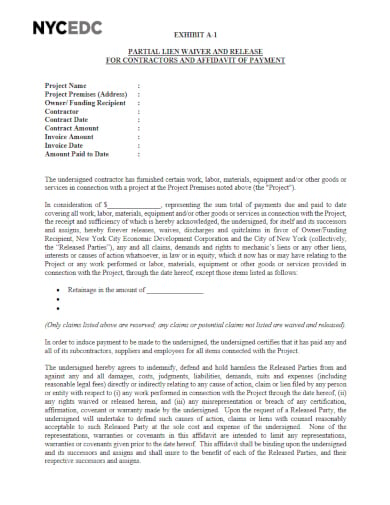

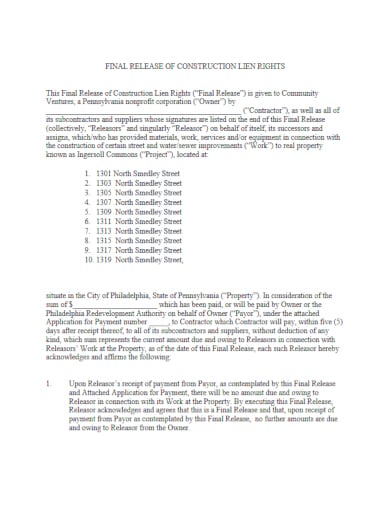

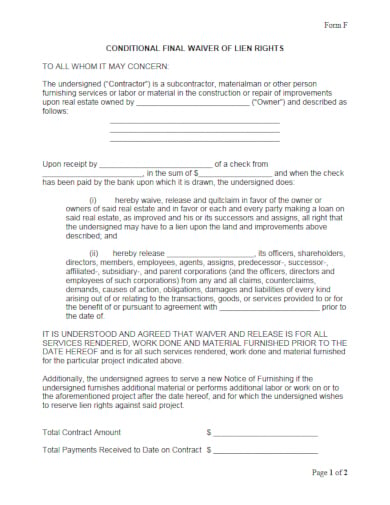

11 Construction Release Form Templates Doc Pdf Free Premium Templates

Free 9 Sample Release Of Lien Forms In Pdf Ms Word

Free 6 Mortgage Release Forms In Pdf Ms Word

11 Construction Release Form Templates Doc Pdf Free Premium Templates

Free 6 Mortgage Release Forms In Pdf Ms Word

Free 6 Mortgage Release Forms In Pdf Ms Word

Free 38 Release Forms In Pdf Excel Ms Word

Free 6 Mortgage Release Forms In Pdf Ms Word

Free 5 Real Estate Lien Release Forms In Pdf

11 Construction Release Form Templates Doc Pdf Free Premium Templates

11 Construction Release Form Templates Doc Pdf Free Premium Templates

Free 5 Real Estate Lien Release Forms In Pdf

11 Construction Release Form Templates Doc Pdf Free Premium Templates

Free 6 Mortgage Release Forms In Pdf Ms Word